Team

Team Dr. Darryl Laws

Dr. Darryl Laws, CEO La Jolla & London

CEO & Chief Investment Officer, 2004, Jermyn Street Capital Partners is a private equity fund manager, Merchant Banker specializing in vetting, structuring, valuing, and negotiating investments and acquisitions on its’ behalf and that of UHNW individuals and prominent families whom co-invest with us.

Jermyn Street Capital Partners, Inc. , based in La Jolla, CA; sold its’ restaurant and hotel assets in: Atlanta, Augusta and Macon, GA, Charleston and Greenville, South Carolina and College Station, TX in October 2022 and is in the process of reinvesting the sale proceeds.

Dr. Laws has held the following positions with private equity funds, investment funds and buyout firms:

Jermyn Street Capital Partners, Inc. , based in La Jolla, CA; sold its’ restaurant and hotel assets in: Atlanta, Augusta and Macon, GA, Charleston and Greenville, South Carolina and College Station, TX in October 2022 and is in the process of reinvesting the sale proceeds.

Dr. Laws has held the following positions with private equity funds, investment funds and buyout firms:

Dr. Darryl Laws, CEO La Jolla & London

CEO & Chief Investment Officer, 2004, Jermyn Street Capital Partners is a private equity fund manager, Merchant Banker specializing in vetting, structuring, valuing, and negotiating investments and acquisitions on its’ behalf and that of UHNW individuals and prominent families whom co-invest with us.

Jermyn Street Capital Partners, Inc. , based in La Jolla, CA; sold its’ restaurant and hotel assets in: Atlanta, Augusta and Macon, GA, Charleston and Greenville, South Carolina and College Station, TX in October 2022 and is in the process of reinvesting the sale proceeds.

Dr. Laws has held the following positions with private equity funds, investment funds and buyout firms:

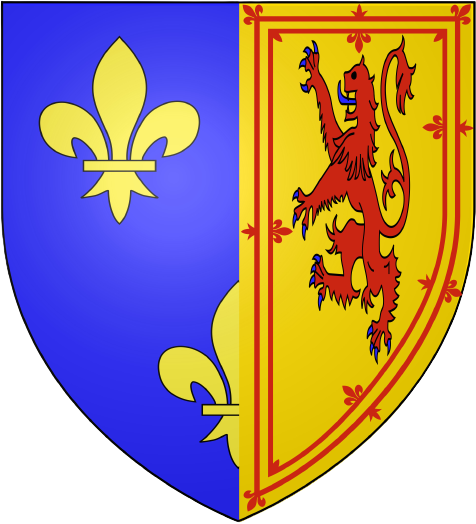

- Managing General Partner, Caledonian Private Equity Partners, 2003–2004, London, U.K. & U.S.

- General Partner, Fortis Bank AG Private Equity, private equity fund restructuring 2002 – 2004, Brussels and Paris,.

- Mg. Partner, Blue C Ventures, January 2000 – January 2002, Vienna, Austria, Paris, France, London, UK.

- CEO & Founder, The Laws Company, Ltd., 1987 – 1998, Newport Beach, CA and London, UK. The Laws Company, Ltd. Commercial Real Estate development company was financially backed by the Guinness Family Trust and the Constantine family office (UK) and Independence Bank, Century Federal Savings & Loan, GATX (Chicago) and NU West Ventures (Hong Kong). I developed a portfolio worth $750,000,000 of high-rise office buildings, industrial parks, and retail shopping centers in: Denver, CO, Atlanta, GA, Riverside, CA, San Diego, CA., Dallas, and Houston, TX.

- SVP, First City Industries, Inc., 1985 – 1987, Beverly Hills, CA, Sr. Vice President on a hostile take-over and mergers and acquisitions team of a company that was owned by Samuel and William Belzberg. We collaborated with Boone Pickens and Carl Icahn on the hostile takeovers: Ashland Oil, Unocal, Bekins Moving & Storage and Scovil Industries.

- VP, Drexel Burnham Lambert, 1982 – 1985, Beverly Hills, CA - junk bond financing for hostile take-overs by the Belzberg brothers, Saul Steinberg, Ron Perlman, and Boone Pickens of Colt Firearms, TWA Airlines, CalCan, Colombia Savings & Loan, Continental Airlines and Mesa Petroleum.

- Development Manager, Trammel Crow Company, 1979 – 1981, Developed the Imperial Bank Tower, a class "A" office tower comprised of 720,000 sf at 600 "B" Street, downtown San Diego and 1,000,000 sf. LTV Tower in Dallas, Texas and 600,000 square feet on the Farm to Market 1960.

- Development Manager, Ernest W. Hahn, Inc., 1976 – 1979, oversaw architecture, engineering and construction and arranged equity and debt financing. Developed and leased of three (3) regional malls; Palm Desert Town Center, Corta Madera Town Center, and Carolina East Mall.

Education

- Doctor of Business Administration, Graziadio Business School, Pepperdine University, 2022,

- Doctor of Business Administration candidate, Finance, Harriot Watt Business School, Edinburgh University, 2014,

- Master of Finance, London School of Economics and Political Science, 2006,

- Master of Public Administration/ Public Finance, California State University Long Beach, 1976

- Bachelor's degree, Business and Commerce & Political Science, California State University, Sacramento, 1974

Dr. Laws fluently speaks: English, Spanish, and is conversational in German and French.

Team Lacarya Scott

MBA, MS, MS, MS, AB – Managing Director

Los Angeles, CA

Tungsten Partners, New York, 2019-2022

- Actively work as part of management as the BD arm for all transactions and strategic decisions

- Lead all levels of transaction execution, including drafting of memoranda, financial, operational and clinical diligence for private placement or PIPEs, and/or partnering (inwards and outwards) Ferghana Partners New York, NY 5/17-1/2019 Investment Banking/Merchant Banking

- Lead all levels of transaction execution, including drafting of memoranda, financial, operational and clinical diligence for private placement or PIPEs, and/or partnering (inwards and outwards) LIPOSEUTICALS, Consultant – Corporate Development and Strategy

- Identified, evaluated, and executed out licensing opportunities domestically and internationally • Executed License on Propofol for China rights • Successfully raised $10 M in financing from an investor out of Hong Kong MESOBLAST INC. Vice President – M&A and Corporate Strategy

- Identified, evaluated, and pursued several M&A opportunities (both companies and products) domestically and internationally (3 M&A deals, 2 licensing/asset purchase, and a strategic alliance)

JERMYN STREET CAPITAL, LLC , Managing Director Performed fundamental research and valuation analysis (DCF, Comparable Company analysis, and M&A comps) for debt and equity investments in public and private pharmaceutical and biotechnology and technology companies. Performed industry research and diligence on each company (diagnostics, biologics, and small molecule companies)

Team Dylan Nobel

Dylan Nobel, Senior Financial Analyst

Dylan Nobel is a seasoned real estate professional with a strong academic foundation and a wealth of experience in the industry. He began his career as a project manager for a development firm based in Los Angeles, CA, where he asset-managed a portfolio of commercial properties valued at over $150M. During his time there, he was directly involved in the development of three medical centers, two gas stations, and a 67-unit apartment building.

After this, he worked closely with a development firm based in Tarzana, CA, to successfully acquire, entitle, build, and sell a 15-unit condominium project and an ultra-luxury single-family development in the San Fernando Valley.

He then worked as an Acquisition Analyst for a boutique firm based in Santa Monica, where he oversaw potential value-add multifamily acquisitions and managed assets under management. During his time there, he successfully negotiated a $28M multifamily acquisition in Downtown Los Angeles and underwrote over $300M in potential acquisitions.

After this, he worked closely with a development firm based in Tarzana, CA, to successfully acquire, entitle, build, and sell a 15-unit condominium project and an ultra-luxury single-family development in the San Fernando Valley.

He then worked as an Acquisition Analyst for a boutique firm based in Santa Monica, where he oversaw potential value-add multifamily acquisitions and managed assets under management. During his time there, he successfully negotiated a $28M multifamily acquisition in Downtown Los Angeles and underwrote over $300M in potential acquisitions.

Dylan has been directly involved in the acquisition and financing of over $350M in commercial projects. He has a deep understanding of due diligence, financial analysis, and has underwritten millions of dollars of complex developments, acquisitions, and joint ventures in all product types.

He holds a Bachelor’s degree in Real Estate & Development, as well as a Master’s degree in Real Estate Finance and Investments from Pepperdine University, Graziadio Business School, both of which have provided him with a comprehensive understanding of the real estate market.

Dylan is an active member of NAIOP San Diego, and the Urban Land Institute (ULI).

Dylan is an active member of NAIOP San Diego, and the Urban Land Institute (ULI).

Jermyn Street Capital Partners, Inc. is a family office and private equity fund General Partner, managed by Darryl Laws, DBA.

Get In Touch

- Dll@jermynstreetcap.com

- 858-203-3512

- 800 Silverado Street Suite 301-D La Jolla, CA 92037

Copyright © 2023 Designed and Developed By Rebrand Gurus